Natural rubber (NR) market foresees a potential tight supply emerging globally by the end of the first quarter of 2024. The trends up to October point to a massive fall in production in major producing countries for the full year 2023.

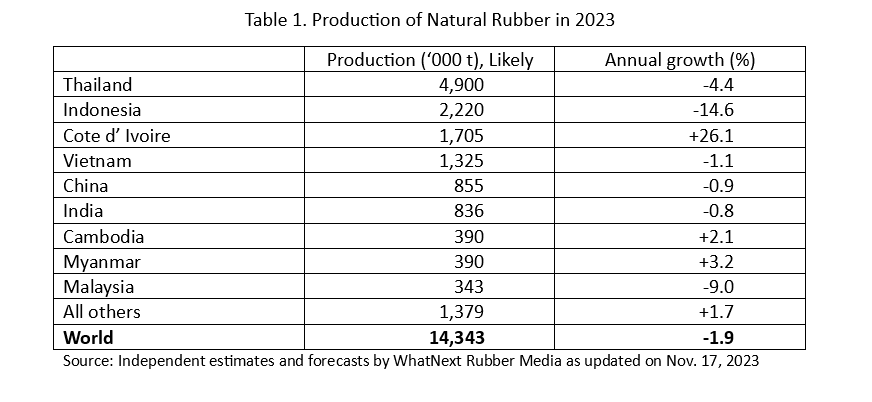

The production in Thailand, the world’s largest producer and exporter, fell by an annualized 9.0% in the third quarter (Jul-Sep 2023). The full-year production in Thailand is heading to a 4.4% fall. Coming to the second largest producer Indonesia, the production in 2023 is expecting a massive 14.6% fall. Malaysia is expecting a 9.0% fall in its NR output during 2023. Coming to other major producing countries, the production is expected to marginally fall in Vietnam (-1.1%), China (-0.9%) and India (-0.8%). However, a whopping 26.1% increase expected in the production from Cote d’Ivoire can partly offset the lower production in the above countries.

Total world production during 2023 is expected at 14.343 million tons, down 1.9% from the year before. Please see Table 1 for getting a consolidated picture.

World Supply Wiped Out by 0.7 Million Tons

As per the outlook reported by WhatNext Rubber Media International in mid-2023, the six-month period from July to Dec 2023 was projected to generate a total surplus of 1.4 million tons, and this would have been adequate to bridge the total deficit of 1.4 million tons projected for the subsequent six months (i.e., from Jan to Jun 2024). However, the scenario has now been drastically changed largely due to the sharp fall in production in Thailand, Indonesia, and Malaysia. The unexpected major output fall in these three countries along with the marginal fall in Vietnam, China, and India have wiped out around 0.7 million tons from the world output expected for 2023. It means the carryover stock available for meeting the shortage expected for the first half of 2024 is now lower by 0.7 million tons from the quantity projected in mid-2023.

Carryover from Pre-2023 Period

To bridge the shortage expected for the first half of 2024, another possibility is to use the stock accumulated over several years prior to 2023. But the world supply was deficit both in 2021 and 2022. Moreover, the larger part of the prior years’ accumulated stock should have been absorbed to meet the deficit in the first half of 2023. The supply during the first half of 2023 was short of the demand by 1.5 million tons. It means an estimated quantity of 1.5 million tons was already used from the stock accumulated prior to 2023. It implies the market cannot count much on the prior years’ accumulated stock. Such a situation points to a tight supply condition potentially emerging by around March 2024. The tight supply condition anticipated by March 2024 can potentially intensify in the succeeding five months (i.e., from Apr to Aug 2024) and possibly evolve into a global shortage in between.

Potential Rebound in Demand by Q4 2024

Economic activities in the U.S. and Europe are expected to start improving by the second half of 2024 triggered by the monetary policy easing by the respective central banks. The most recent inflation trends and key economic readings indicate the possibility of the U.S. Federal Reserve and the European Central Bank (ECB) beginning their interest rate-cutting cycle by the first half of 2024. The economic recovery momentum can potentially buoy the demand prospects for NR by the fourth quarter of 2024. The improving demand prospects can make auto-tire manufacturing companies aggressive in sourcing NR ahead of the subsequent off-season of NR production. It implies that the tight supply condition can prevail even beyond Aug 2024 in view of a potential rebound in the demand, especially from the U.S. and Europe.

The tight supply condition potentially emerging by March 2024 and its subsequent exacerbation signal the possibility of NR prices undergoing a trend-break by the end of the first quarter of 2024. The uptrend can begin even earlier as speculative investors start betting on the imminent global shortage.

Will the Uptrend Sustain?

Once the prices rebound, farmers will be enthused to increase the output by adopting various short-term measures to enhance the yield of latex from their existing trees. This can markedly take the supply higher when farmers resume tapping after the ‘wintering’ off-season. The favorable prices are likely to take world supply up as farmers the world over try to extract the maximum yield from their holdings. The large extent of mature trees that have been left idle over several years in Indonesia, Thailand, India, Myanmar, Malaysia, and Sri Lanka will be re-opened for tapping once the prices become attractive.

How much additional supply can be expected in each country in response to the expected upswing in prices?

Once the world supply markedly increases following the upswing in the prices, how will it impact the supply-demand fundamentals?

Can the expected upswing in the prices sustain beyond mid-2024?

For a closer understanding of the emerging supply-demand fundamental and price dynamics for the short, medium, and long term, covering the period up to 2030, please refer to the Monthly Report available at www.whatnextrubber.com

Link: https://whatnextrubber.com/reports/

Please share your feedback in the comment box or email at contact@whatnextrubber.com

Author

Jom Jacob

Chief Analyst & Co-Founder, WhatNext Rubber Media International