Natural rubber prices dropped in the range of 7 to 15% during August across different grades and markets. In the Bangkok FOB market, the prices, in the dollar terms, fell by 7.1% for TSR20, 8.7% for RSS3 and 7.4% for latex60%. Block rubber is the dominant form of natural rubber produced in Thailand and TSR20 is the benchmark grade. In the Kuala Lumpur market, SMR20 dropped by 7.3% and latex by 7.4% during August. In Kottayam market in India, while the benchmark grade RSS4 fell by 7.2%, latex60% tumbled by posting a 14.2% fall during August. The downswing in the prices across different grades and geographical locations, both in the physical markets and futures markets, are depicted below:

Are the downswings driven by excess production?

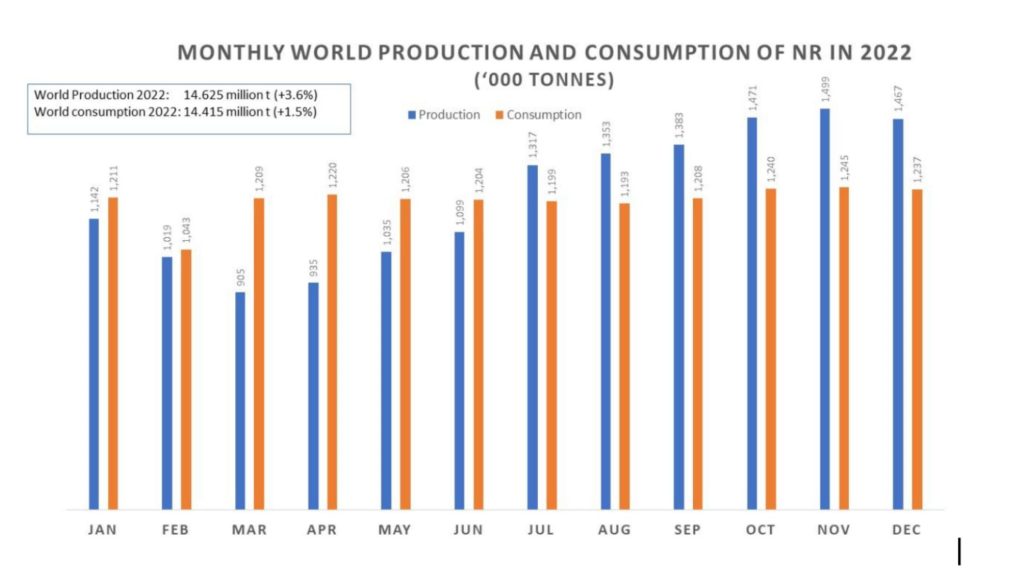

World production in 2022 is anticipated at 14.625 million tons, up 3.6 % from the previous year. Anticipated world consumption in 2022 is 14.415 million tons, up 1.5% from the previous year. The excess supply during the year comes to 210,000 tons only, or 1.5% of the world demand, which is insignificant compared with the size of the world market.

But the period from mid-July to mid-Dec is the peak production season for natural rubber globally. Due to the peak season, the expected monthly production is more than the consumption for all the months from July to December. This point is evident from the following chart which shows the monthly global production and consumption in 2022.

What is the possibility of world demand gaining momentum and absorbing the excess supply?

The demand outlook for natural rubber is increasingly challenged by brewing economic recession risk. The aggressive policy tightening and anticipated further rate hikes by central banks in the developed world can potentially dent post-Covid economic recovery momentum. This can dampen the demand prospects for NR as well.

China is accounting for around 42% of the global demand for natural rubber. The demand prospects from China are particularly challenged by the disrupted manufacturing activities in the country and the prevailing shattered state of property sector accounting for a quarter of the Chinese GDP. The “zero-Covid” policy and the continuing Covid-related restrictions imply that China can take longer time to return to normal growth track. Moreover, parts of China’s western provinces are reportedly hit by power shortage and forced power cuts caused by heat waves and severe drought. The aggressive policy tightening in the developed world and the situation prevailing in China suggest that the projected to 1.5% increase in the world demand for NR in 2022 is subject to high downside risk. In that case, the excess supply would be more than what is now projected.

Are the downtrends in rubber prices influenced by geopolitical factors?

Several non-fundamental factors are currently weighing on natural rubber market. They include geopolitical tension between China and Taiwan, geopolitical uncertainty arising from the prolonged Russia-Ukraine war, unending Covid-lockdowns in several parts of China, the dollar’s sharp strengthening to a nearly two-decades high, and the continuing weakness in the currencies of major NR-exporting countries. Market sentiment and investor confidence are weighed down by the risk and uncertainties arising from the above factors.

In the Indian market, what are the key factors driving the prices down?

In India, around 65% of the produce is processed and traded in the form of RSS. This is in sharp contrast with the block-rubber dominated global market structure. India’s benchmark grade RSS4 lost 11.5% between July 1 and August 26.

The downtrend in the Indian market is largely driven by global cue. The Indian market is also weighed down by a better-than-expected domestic supply amid the weak monsoon rains in the State of Kerala during the first three weeks of August, facilitating uninterrupted harvesting during the period. Another factor having negative implications for the Indian NR market is that the shipping logistics sector has returned to normal and ocean freight rates have sharply come down, making the NR imports faster and cheaper. As such, the auto-tyre manufacturing companies in India no longer face any uncertainty in accessing NR from overseas. This favorable condition enables Indian tyre companies to optimize their inventory of NR and in the attempt to squeeze the inventory cost.

Are cheaper imports from Ivory Coast influencing the Indian NR market?

Indian tyre companies are increasingly sourcing NR from Ivory Coast. India’s NR imports from Ivory Coast zoomed 100% during Jan-June 2022 compared with the same period in the previous year. India imported 54,000 tons of NR from Ivory Coast during Jan-June 2022 compared with 27,000 tons during the same period in 2021.

The CIF prices (Ocean freight and Insurance are included) of block rubber imported from Ivory Coast are 5% to 12% lower compared with the block rubber sourced from Southeast Asian countries during the same month. Please see the unit CIF value of block rubber imported in India during June 2022 from Indonesia, Malaysia, Thailand, Vietnam and Ivory Coast.

| Indonesia | $207.80 per 100 kg |

| Malaysia | $201.70 ” “ |

| Thailand | $198.90 ” “ |

| Vietnam | $192.80 ” “ |

| Ivory Coast | $193.30 ” “ |

The low-cost rubber originating from Ivory Coast and other African countries has started impacting on Indian NR market and the income of the farmers in India.

Are rubber prices in India impacted by huge imports of compound rubber which are levied a lower import tax tariff in India?

India imported 66,000 tons of compound rubber (HS codes 400510, 400591 and 400599) during H1 2022 (Jan-Jun 2022). Out of this, 28,000 tons were imported from countries such as the U.S., Canada, and South Korea which are not NR producers or exporters. Obviously, this quantity (28,000 ton) cannot be guised imports for the evasion of import duty as widely alleged. The remaining quantity (38,000) imported largely from Thailand and Malaysia could be guised imports. But this quantity (38,000 tons) constitutes only 11.5% of India’s total NR imports during Jan-Jun 2022. India’s imports of compound rubber from Indonesia, Vietnam, or Cambodia are either negligible or nil. Please see the following table.