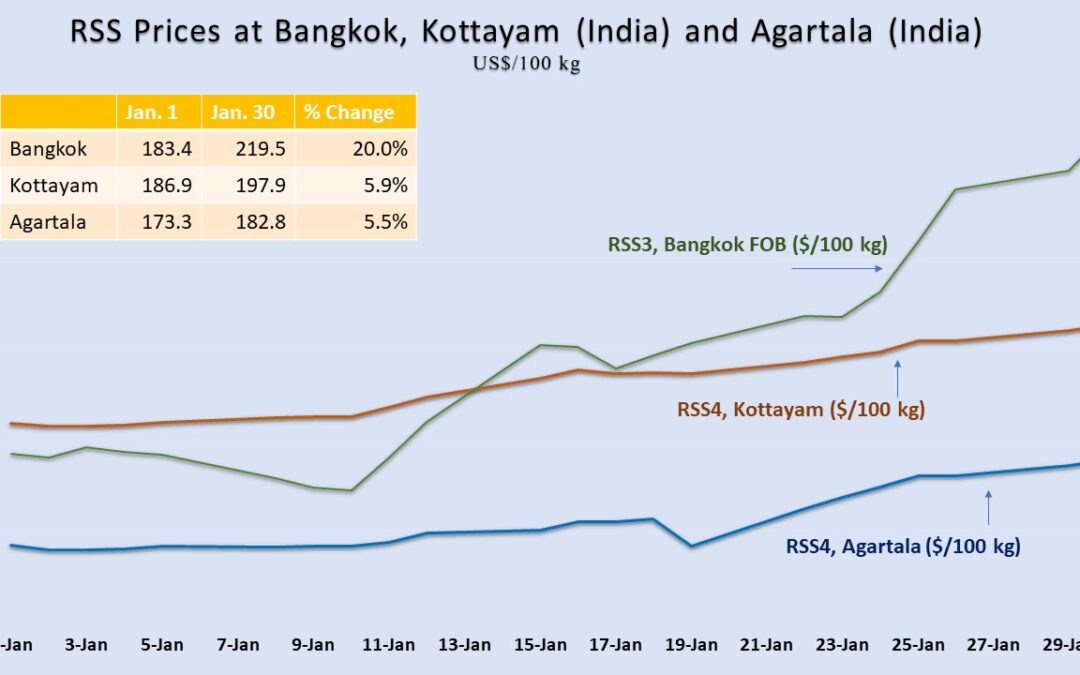

The prices of RSS3 at Bangkok FOB, the global benchmark grade of ribbed smoked sheet of natural rubber, soared 20% over the first 30 days of January 2024. RSS prices at Bangkok are poised to scale further up and continue along a rising curve for the next six months, as per the emerging supply-demand outlook from WhatNext Rubber Media.

Kottayam Market Stays almost Immune to Global Rally

In India, around 70% of the total production of natural rubber (NR) is processed and traded in the form of RSS. This is in sharp contrast with the global pattern where TSR or “block rubber” contributes around 65% of the output. “RSS4 at Kottayam” is India’s benchmark reference price for NR (Kottayam is the largest NR producing district in the State of Kerala, the traditional rubber-growing region of India). Surprisingly, RSS4 prices at Kottayam rose only 6% during the first 30 days in Jan 2024 against a 20% jump at Bangkok market during the same period. Kottayam market used to rule above the Bangkok market by 20% to 30%. Moreover, Kottayam market used to track the rally at Bangkok market. In sharp contrast with the earlier pattern, Kottayam market stayed almost immune to the sharp gains at Bangkok market in January. Moreover, Bangkok market crossed over Kottayam market on January 12, 2024. (Please see the chart given above). What are the factors that prevented Kottayam market from gaining in tandem with the 20% surge at Bangkok market? Is this a temporary phenomenon, or a new normal?

Indian Auto-Tyre Industry Shifts from RSS to TSR

A comparison between the RSS markets in India and Thailand used to be relevant during the past when Indian auto tyre manufacturing companies predominantly consumed RSS unlike the TSR-dominant manufacturing followed by their counterparts outside the country. Over the past nearly 10 years, the Indian auto tyre companies have largely shifted to a TSR-based manufacturing by deviating from the hitherto followed RSS-based manufacturing. Because of the RSS-based manufacturing followed in the past, auto-tyre companies in the country used to source NR after making a comparison between the cost of domestic RSS and imported RSS. That practice has changed over the past 10 years due to the shift from RSS to TSR. The Indian auto tyre manufacturing industry currently turns to domestic RSS only is it is economically more attractive than souring TSR from overseas. It means, the cost of imported RSS is no more relevant to the Indian auto-tyre companies due to the shift to TSR. The prices of TSR are considerably below RSS prices. The point is that the shift from RSS to TSR by the Indian auto-tyre manufacturing companies has made Kottayam RSS market almost insensitive to the RSS market at Bangkok.

Sourcing Shifts from Indonesia to Ivory Coast

Auto-tyre manufacturing companies in India have recently shifted their sourcing of TSR. Earlier they used to source TSR largely from Indonesia and other southeast Asian NR producing countries. Ivory Coast has become the preferred source for the Indian auto tyre companies for sourcing TSR over the past two years. It means that auto-tyre manufacturing companies in India currently source RSS from domestic market only if they find it more economic than souring TSR from Ivory Coast. From this perspective, it is the TSR prices prevailing in Ivory Coast that influences the Kottayam RSS market rather than the RSS prices at Bangkok. The close link between the Indian RSS market and the Bangkok RSS market is a story of the past which is no more relevant in the changed scenario.

Increasing Influence of Low-Cost Rubber from Northeast India

In meeting the demand for RSS, Indian tyre industry can now increasingly rely on northeast India which is a non-traditional region having considerable cost advantage over the traditional region (State of Kerala). In the northeast India, the prices of RSS4 (Agartala Market is the reference market for northeast India) are around 10% lower compared to Kottayam. India’s northeast currently accounts for around 20% of the country’s total output of NR. As a new trend, major auto tyre manufacturing companies currently bring RSS from northeast India to their factories located in Kerala because of the substantial cost advantage. It means, the RSS market in Kerala currently faces competition not from imported RSS, but from the RSS produced within India, in the country’s northeast, at a substantially lower cost. The low-cost RSS coming from northeast India is exerting a downward pressure on RSS market in the traditional region, especially the State of Kerala. This trend in expected to continue with an increasing influence. It means, it’s not a temporary happening, but a new normal.

Northeast India to Contribute more than 50% of India’s Rubber Output

The Rubber Board, by joining hands with India’s Auto Tyre Manufacturers’ Association (ATMA), has launched a massive rubber cultivation project in northeast India envisaging expansion of rubber cultivation by 200,000 hectares by 2025. This can bring an additional output of around 300,000 tons per year when the planted trees attain maturity by early 2030s. With this additional production, the share of northeast India in the country’s total production is expected to go beyond 50%, from the current level of 20% (Northeast India is projected to produce around 525,000 tons of NR by 2032 if the ongoing planting programme in the region achieves the target). It means, the Kottayam RSS market should expect more dominating negative influence of the low-cost RSS coming from northeast India in the years ahead.

Kerala’s Shrinking Rubber Map

With the increasing dominance of low-cost NR from northeast India, rubber farmers in the State of Kerala will be ultimately left with no option but selling the produce at prices matching with those prevailing at Agartala. The dominating influence of low-cost NR from northeast India, along with the abnormally high wages in Kerala, higher cost of material inputs, and a considerably lower purchasing power of rupee in the state, will make rubber cultivation economically unviable in Kerala. It means, parallel to the expansion of cultivation in the northeast India, Kerala should expect a marked shrinkage of rubber area. The possibility of Kerala getting almost fully wiped out from India’s natural rubber production map cannot be ruled out.

Prices are Right for Exports

Conditions are now ideal for India to exploit the higher RSS prices overseas. The wide gap between the RSS prices at Kottayam and Bangkok, and that between Agartala and Bangkok, offer immense scope for India to tap the global rally in RSS prices and thereby support the farmers. A policy initiative along this direction can also help Indian RSS market to gain momentum and move in tandem with the surging Bangkok market.

Your perspective that the Indian rubber market may soon align with international trends, especially if global prices remain high due to material shortages and off-season production dynamics, is quite plausible. India’s response to global market trends could indeed be influenced by its own production cycle, which might lag behind other major rubber-producing countries. This delay could lead to a reactive adjustment in the Indian market, particularly if the international market continues to experience tight supply and elevated prices.

Thank you for your feedback, Mr. Pankaj