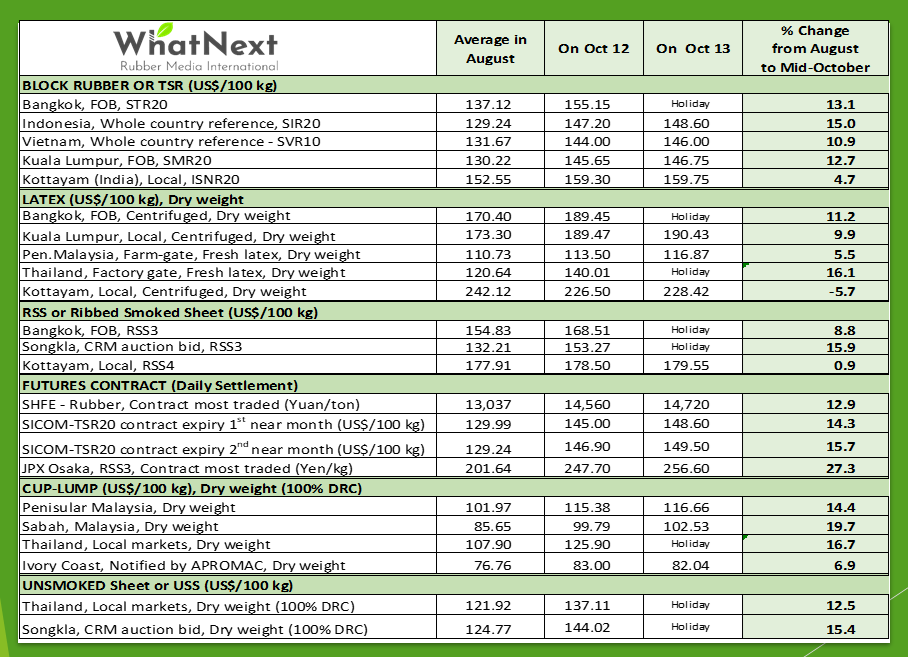

Natural rubber (NR) prices soared 10-15% in key Southeast Asian physical and futures markets between end-August and mid-October. Please see the attached table showing the percentage increase for different forms of NR in key markets.

Charts of daily futures contract prices at the Shanghai Futures Exchange, SICOM Exchange, and JPX Osaka as well as the physical prices at Bangkok, Kuala Lumpur, and Kottayam can be viewed at https://whatnextrubber.com/rubber-price-charts/

The period from mid-September to mid-January every year used to be the peak production season for NR globally. The comfortable supply during this season used to weigh on the prices every year. Strikingly, in sharp contrast with the usual pattern, the world supply is not showing any seasonal up this year although it is already mid-October.

What’s Happening to the Supply?

Several factors are keeping the production low, especially in Thailand which is the world’s largest producing and exporting country. Since the beginning of the current tapping season, the production from Thailand has reportedly come down every month by more than 10% from the corresponding month in the year before. This is largely due to tapping disruptions caused by almost incessant rains across the key rubber-growing regions in the country. The changed rain pattern is painfully impacting the rubber output in the world’s largest-producing country. Apart from this factor, the yield of latex from rubber trees is presumably impacted by the outbreak of a circular fungal leaf-spot disease and its large-scale spread (Around 150,000 ha) over the past four years in the country’s traditional rubber-growing provinces. The yield could also have been impacted by the unusually severe hot weather and heat waves that were felt in the key rubber-growing regions in Thailand. The production of NR from Thailand in the full year 2023 is projected to be down 6.0% (For more insights, please refer to WhatNext’s latest monthly market intelligence reports available at https://whatnextrubber.com/platinum/

In Indonesia, the second largest producing and exporting country, the production during the current year (2023) is expected to be down 13.0% after a 13.2% fall in the year before. The production in Malaysia is expecting a 10.4% fall in 2023. Of course, the factors impacting the NR output are different for different countries. For insights into the production trends in Indonesia and Malaysia and the underlying factors, please refer to https://whatnextrubber.com/platinum/

The falling supply of NR in Southeast Asia is offsetting the weak demand, especially from China, the U.S., and Europe.

Speculative Buying in Shanghai Futures

The rally in rubber prices during the week of Oct 9-13 is led by speculative buying in the Shanghai Futures Exchange. Speculative investors are looking ahead for large-scale investments by China’s state-backed funds as part of a major governmental initiative to shore up the country’s beleaguered capital market. China’s trade report for September, released on Friday (Oct 13) gave clear signals that the world’s second-largest economy, and the largest consumer of NR, is gradually returning to stability. The trade report further helped in lifting investor confidence.

Looming Supply Uncertainty

Finally, I have an important question. The peak production season (i.e., the period from mid-September to mid-January) every year generates a surplus ranging from 1.2 to 1.5 million tons of natural rubber globally. It is this carryover stock that helps end-use manufacturing companies meet their requirement during the lean production season (From February to June).

If the usual season of peak production (i.e., the period from mid-Sept to mid-Jan) goes without generating a surplus, end-use manufacturing companies will face an acute shortage of natural rubber during the lean production season (i.e., from Feb to Jun). Such a situation cannot be ruled out. Let’s closely monitor the production trends in the first two largest producing countries (Thailand and Indonesia) and see how much surplus is globally generated when the peak season ends by mid-January.

Author: Jom Jacob, Chief Analyst, WhatNext Rubber Media International

(The author can be reached at contact@whatnextrubber.com or jomjacob2004@gmail.com)